1031 Exchange Expertise

Maximize Investments

How We Help Defer Capital Gains Taxes & Maximize Your Investments

Qualified Intermediary Services

Defer All Tax on Capital Gains

Tax Efficiency Guidance

The Qualified Intermediary holds your 1031 exchange funds and aids in the administration of your exchange.

A §1031 exchange allows you to defer: capital gains tax (20% or 15% rate); 3.8% tax on net investment income, taxation on depreciation recapture (25% rate); and the applicable state tax rate. Deferring these taxes gives you more equity to reinvest.

Our Multi-discipline & multi-market expertise allow us to identify possible pitfalls resulting in the overpayment of tax.

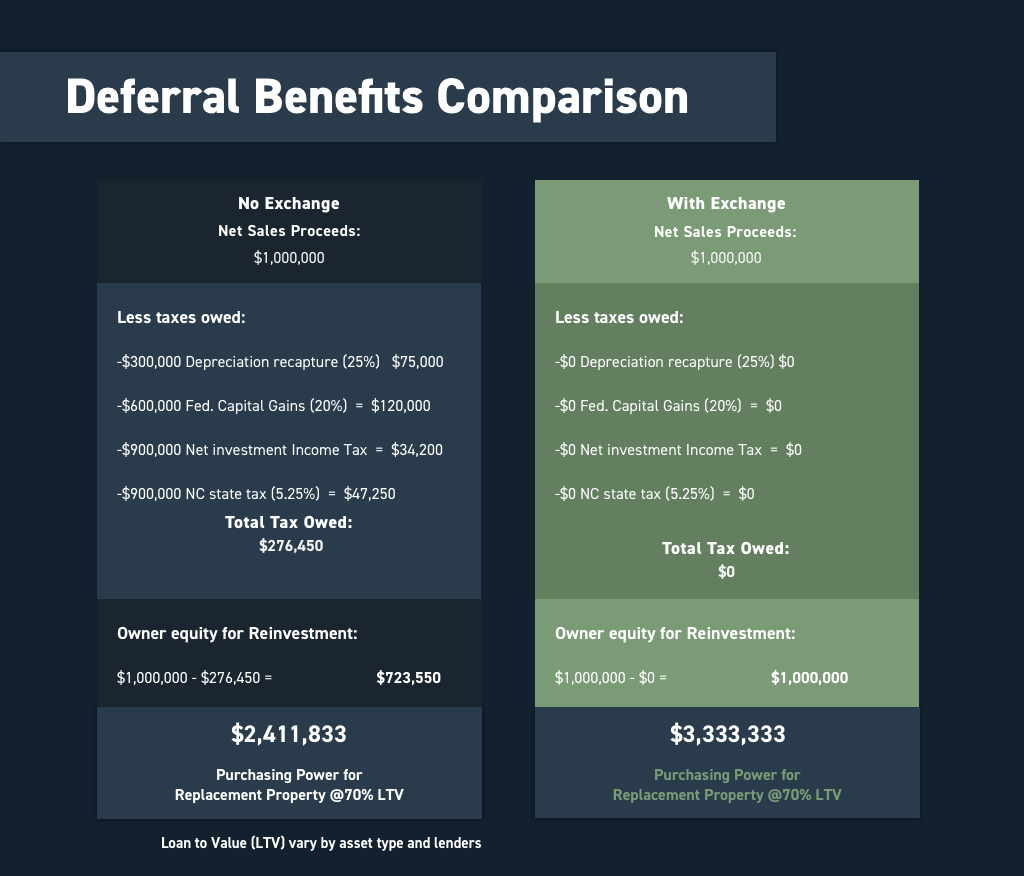

Deferral Benefits

Here’s an example. Assume a married couple filing jointly sells an investment property in NC for $1,000,000 (net of closing costs) with no debt. The couple originally purchased the property for $400,000. $300,000 of the initial purchase price (or 75%), was allocated to the building and the building has been fully depreciated over time.

The couple’s capital gain is approximately $900,000 (today’s net sales price of $1,000,000 minus the net adjusted basis of $100,000) and this sale transaction is the only source of the couple’s investment income. If the couple’s modified adjusted gross income is $1,400,000 ($500,000 of income from other sources and $900,000 of capital gain from this sale), here are the sale vs exchange ramifications:

Without an exchange the couple will be taxed at the following rates:

25% on their prior depreciation deductions taken, 20% for federal capital gains, 3.8% for the net investment income tax, and 5.25% for the North Carolina state tax bracket. With an exchange, these tax rates won’t apply.

Go Local with National Reach

Our Carolina’s based team has extensive local market experience to guide our clients. However, we also have national real estate and exchange experience to facilitate your exchange wherever your replacement property is located in the U.S.

Multi-Discipline Expertise

We’re able to deliver superior service and results because of our unique combination of legal training, real estate market experience, and property tax expertise. Thus, as an extension of your team, we build on your knowledge, and work to achieve optimal results while minimizing the time demands on you and your staff.